Almost immediately after pressing send on last month’s note, stock market volatility resurfaced due to concerns over inflation and interest rates. But like recent stock market selloffs, lower prices attracted bargain hunters, propelling stocks back to record highs. Over the last several weeks, we’ve been on a seesaw between “risk-on” (technology growth stocks rally) and “risk-off” (materials, industrials, financials value stocks outperform) as the market is whipsawed by several crosscurrents, including:

- 10-year Treasury yield rising to 2%

- Concerns over taxes and the potential impact on 2022 corporate earnings

- Increased consumer spending due to the stimulus

- 2021 corporate earnings estimates are still rising

So far, the 2021 stock market reminds me of 2013 when the stock market experienced three peak-to-trough declines of 5-10% driven by concerns over inflation and increasing rates. Long-term rates ended up increasing 80% in 2013, and while the market experienced some volatility, the stock market finished up +30% due to optimism for growth, gains in efficiency, and an accommodative Fed.

Comparing 2013 to 2021:

- Since the start of the year, the S&P 500 has experienced two -5% selloffs (2013 had three selloffs).

- January saw the largest ever hedge fund de-grossing (forced selling) in history, and the market barely budged signaling strong demand/buying pressure.

- The February sell-off created a 12% decline in Technology stocks, thus, it was a 10% correction, and many overvalued and overhyped stocks have come back to earth. This is healthy for the market.

- The 10-year treasury bond yield is up approximately 80% year-to-date. Even if long-term rates continue to climb, looking back at 2013, we have recent precedent for stock market rally accompanied by a massive increase in the 10-year treasury yield.

As I mentioned in last month’s note, there are several positive catalysts for this market including:

- Pent up demand that will be released when we reopen (prices on flights and hotels are already going up).

- Fiscal (government) stimulus checks.

- Valuations are reasonable (assuming rates level off).

- Innovation is still strong.

- Covid-19 and the lockdowns have made companies more efficient.

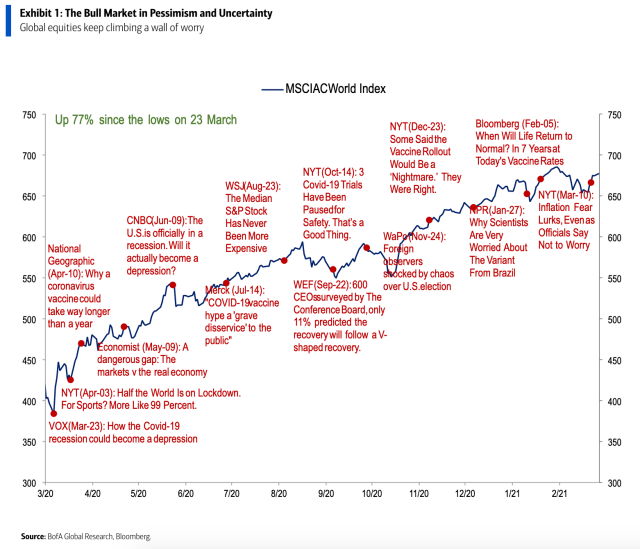

Yes, there are concerns, but there is always something to be concerned about. There is a saying that “the stock market climbs a wall of worry” and we have seen this play out over the last year. The chart below highlights the stock market rally in the face of negative headlines.

As a result, our convictions remain consistent, and we are positioning portfolios and investment implementations in the following way:

- For clients who are funding portfolios with cash, we are being cautious with the implementation and staging in over a period of 3-4 months.

- For clients who are fully invested, we are fully diversified across our equity portfolios with a bias towards quality, growth, and companies poised to benefit from the economy reopening.

- We are diversified across U.S. stocks, Non-U.S. Developed stocks, and Emerging Market stocks.

- We are underweight Fixed Income.

- We are biased towards high quality Fixed Income. In other words, we are not getting compensated to take risks in Fixed Income and we are willing to accept lower rates in exchange for preservation of capital.

If you would like to speak about your portfolio in greater detail, please feel free to reach out to schedule a meeting.