In June 2020, Federal Reserve Chair Jay Powell said at a press conference, "The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus. We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to reengage in a broad range of activities."

Since these comments, the economy has enjoyed a strong recovery, but the current spread of the Delta variant has investors questioning the pace of growth going forward.

If you listen to the financial media, your neighbors, co-workers, etc., you get the sense that the market is due for a correction, and there are no shortage of concerns:

- The Delta variant’s impact on travel and hospitality

- The collapse in consumer confidence

- Concerns over vaccine reluctance and questions of vaccine effectiveness on neutralizing the Delta variant

- The market at all-time highs

- Potential Federal Reserve tapering

And the list goes on.

In other words, the glass is half empty.

Glass Half Empty

Fear in the air. Significant events have been canceled and spreads on bonds have widened. While news on the Delta variant may seem to be the primary source of fear, a recent Bank of America Fund Managers survey found that the Delta variant was number four in the line of major concerns, behind inflation, a taper tantrum, and asset bubbles.

Investors are concerned, and the data confirms this story:

- Retail investors liquidated equities in three consecutive weeks, the longest stretch so far this year.

- Institutional investors have been liquidating equities for the past five weeks.

- The level of bearish sentiment is the highest since October of 2020 – right before the election.

Translation: Investors are more negative about stocks and the economy than at any point in the last 12 months. So, are things really that bad?

Glass Half Full

The Delta variant is a concern, but when you look at the actual impact of Delta on economic projections so far, it’s small. Consensus economist forecasts dropped only slightly from 6.5% growth to 6.2% growth in 2021, and growth estimates for 2022 were raised by about the same amount. So, pent-up demand is not being destroyed; it is being postponed.

In addition, corporate earnings continue to be strong, and companies are sitting on record amounts of cash and unused credit.

So, what could drive this market higher?

- Strong markets stay strong

- Reported corporate earnings and revenue are beating expectations

- Corporate balance sheets are strong (including banks)

- The Federal Reserve is committed to keeping interest rates low

- Fiscal stimulus – infrastructure

Of all these tailwinds, the one to pay close attention to is earnings.

The current consensus expectation for earnings growth in 2021 is 22%. While there will be a handful of high-profile misses, the results are likely to be quite good, providing more fuel for equity markets.

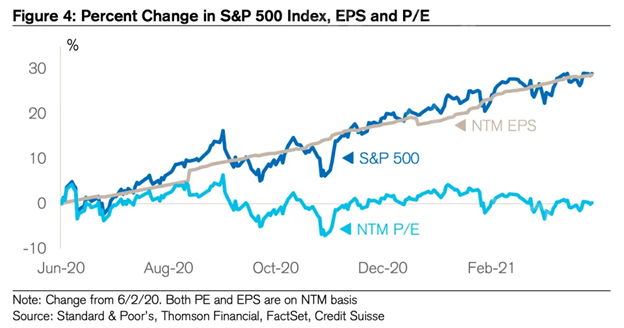

Over time the stock market follows the path of expected corporate earnings, and the last year (ending 6/30/21) has been no exception. Looking at the chart below, stocks have moved in lockstep with expected corporate earnings growth, and as a result, valuations have remained consistent.

But valuations are elevated and need to come down, right?

While valuations are elevated based on historical Price/Earnings ratios, this ignores the impact of low interest rates.

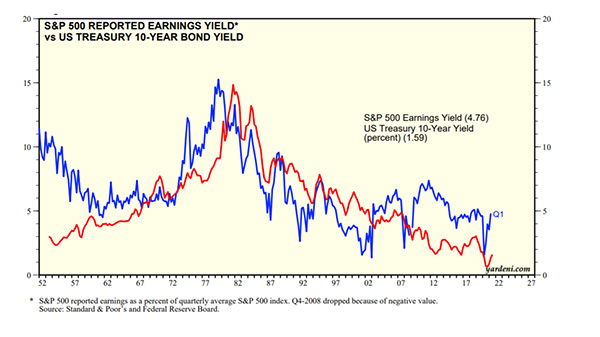

My favorite valuation metric is the spread between the “earnings yield” (S&P 500 earnings divided by price) and the 10-year treasury bond.

Currently, the spread is around +3%. In other words, you earn a premium for owning stocks compared to a “risk free” asset. In contrast, the spread between the earnings yield and the 10-year treasury bond was (-4%) at the height of the technology bubble and (-2%) at the height of the real estate bubble.

The chart below highlights this relationship.

Translation: While stock market valuations look high compared to history, when put in the context of historically low interest rates, stocks are reasonably valued and not in bubble territory. Corporate earnings continue to be strong, and there is a lot of cash on the sidelines looking for a home.

August is a Tricky Month

We’ve experienced a fair amount of volatility this August, but elevated volatility in August is normal. August can be a tricky month for investors as light trading volume can result in “air pockets” of volatility. This phenomenon has held up this August with volatility being exacerbated by the concerns highlighted above, namely, the Delta variant and potential Federal Reserve tapering.

What is tapering and why is it a concern?

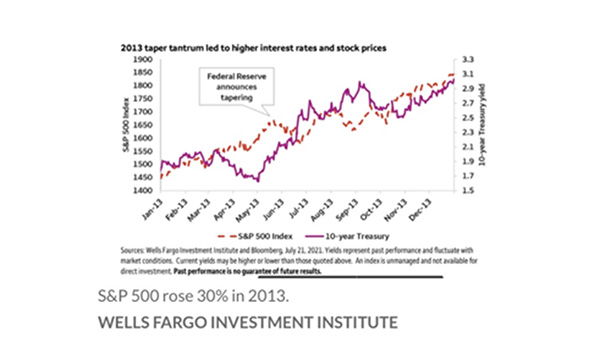

While the Federal Reserve is likely to keep rates at 0% through 2021, they may slow (taper) their purchase of assets (U.S. Treasury, Mortgage, and Corporate Bonds). What this means is the Federal Reserve will continue to add liquidity and support to markets, but at a slower rate. The last time the Federal Reserve announced a tapering program was in 2013, and the market dropped close to 10% in the span of three weeks.

So, should investors sell and wait for the Fed’s announcement?

Absolutely not.

The 2021 stock market reminds me of 2013 when the stock market experienced multiple peak-to-trough declines of 5-10% driven by concerns over inflation and increasing rates. The “taper tantrum of 2013” was disruptive for both stocks and bonds with stocks selling off 5-10% in a matter of weeks and long-term rates increasing 80% for the year. That said, the stock market finished up +30% due to optimism for growth, gains in efficiency, and an accommodative Fed, and the market rally continued for another 20 months.

Glass Half-Empty or Half-Full?

We remain in the camp of glass half full and are committed to our long-term strategic allocations, with a tactical overweight to stocks over bonds.

- For clients who are funding portfolios with cash, we are staging in over a period of 3-4 months.

- For clients who are fully invested, we have a bias towards quality, growth, and sectors poised to benefit from the economy reopening.

- We are diversified across U.S. stocks, Non-U.S. Developed stocks, and Emerging Market stocks, with an overweight to U.S. stocks.

- For clients with long-term time horizons and an increased capacity for volatility, we are adding a 1-3% exposure to Crypto currencies (Bitcoin and Ethereum).

- We are underweight Fixed Income.

- We are biased towards high quality Fixed Income. In other words, we are not getting compensated to take risks in Fixed Income and we are willing to accept lower rates in exchange for preservation of capital.

If you would like to speak about your portfolio or wealth plan in greater detail, please feel free to reach out to schedule a meeting.