With stocks posting a strong start to 2021, there is growing sentiment that this market is a "speculative bubble". While there are certainly signs of speculative excess in pockets of the market (SPACs, Junk Bonds, Crypto Currencies, GameStop, etc.) we remain constructive on stocks due to the following:

There remains a positive gap between COVID-19 trends versus the public perception.

An economic recovery is underway. This strong economic backdrop is becoming more evident with each passing month.

Both Fiscal and Monetary Policy remain supportive.

Positive COVID-19 Trends

The primary priorities for President Biden’s first 100 days in office are financial relief for those hit the hardest by the pandemic and the COVID-19 vaccine rollout.

As far as COVID-19 trends are concerned, broadly speaking, COVID-19 news continues to be positive as cases recede.

US COVID-19 case trends:

- Daily cases - 52,767 vs 78,866 7 days ago, down -26,099

- 7-day positivity rate - 6.4% vs 7.9% 7 days ago

- Hospitalized patients - 65,455, down -18% vs 7 days ago

- Daily deaths - 2,420, down 15% vs 7 days ago

Vaccinations ramping steadily

- average 1.6 million this past week vs 1.4 million last week

- overall, 4.0% have 2-doses, 10.9% 1-dose

Source: COVID-19 Tracking Project: https://covidtracking.com/

Economic Recovery

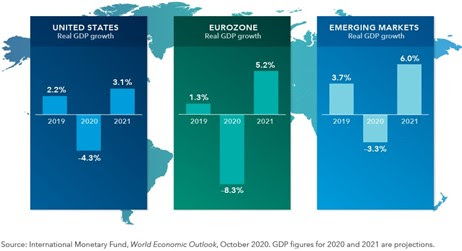

With a vaccine-assisted recovery already underway, the U.S. economy is expected to grow over 3% in 2021 — and potentially 4% — depending on how quickly and effectively the government moves to distribute stimulus checks and vaccines.

If the U.S. can swiftly administer millions of COVID vaccines by midyear, we could experience one of the strongest U.S. GDP growth rates of the past decade.

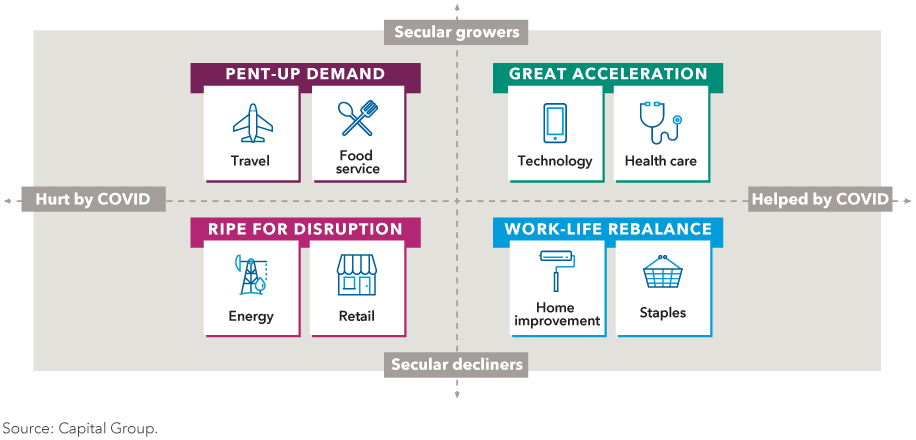

It is important to note that the world is going to look much different coming out of this pandemic. In many respects, COVID-19 was more of an accelerator for certain trends as opposed to a change agent, and there will be winners and losers when the global economy reopens. Below is a framework for evaluating the winners and losers in a post COVID-19 world.

Fiscal and Monetary Policy Remain Supportive

On the financial relief front, President Biden recently announced that he will seek rapid approval of a $1.9 trillion spending package that includes $400 billion for vaccine deployment and school reopening, $350 billion to help state and local governments, and $1,400 direct payments to individuals, among other assistance for displaced workers.

Treasury Secretary Janet Yellen was recently interviewed on CNBC and she made a strong case for aggressive stimulus. One of her key points is that "negative risks of going bigger are far smaller than the negative impacts of doing too little".

In addition, the environment and climate change initiatives could move front and center, including policies to encourage green investing and more disclosure requirements for public companies related to environmental, social and governance (ESG) matters.

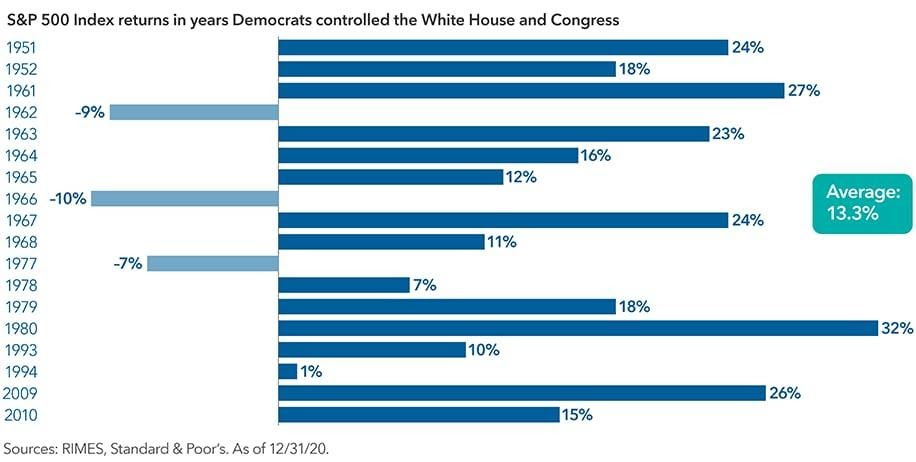

While there was initial concern over a unified government, historically speaking, the stock market has experienced strong returns in years when Democrats controlled the White House and Congress. This time around may not be different as Democrats push through larger stimulus bills and infrastructure projects.

Finally, the Federal Reserve is committed to keeping interest rates low, adding support to higher-than-average stock market valuations.

How?

Let’s look at the spread between the “earnings yield” (S&P 500 earnings divided by price) and the 10-year treasury bond.

Currently, the spread is around +3%. In other words, you earn a premium for owning stocks compared to a “risk free” asset – a 3% spread is close to the highest we’ve seen in the last 20 years. In contrast, the spread between the earnings yield and the 10-year treasury bond was (-4%) at the height of the technology bubble.

Translation: while stock market valuations look high compared to history, when put in the context of historically low interest rates, stocks are reasonably valued.

Reasons for Concern

So, what could go wrong?

As always, investors can cite a long list of reasons to be cautious on stocks.

- Corporate taxes are likely going up

- Texas is facing a humanitarian crisis

- Storms wreaking havoc across the U.S.

- Washington suggesting new legislation to audit "50% of millionaires"

- Minimum wage hike gaining momentum

- Interest rates are rising

- Inflation concerns picking up given oil + commodity surge

- Washington GameStop hearings could lead to new regulations

- Jobless claims were terrible

Of the primary concerns, a slower than expected reopening and higher interest rates are top of mind.

Slower than Expected Reopening

While the vaccine rollout is picking up steam, it could still be six to nine months before a vaccine is widely distributed. The time between now and full herd immunity could allow the virus to mutate, causing further spreading and delays to the reopening.

An estimated 7% of US cases are "mutations" and this share is expected to grow. The key question is whether it creates a 4th wave.

As reported by the New York Times, the CDC pledged $200 million to track new variants. This news is encouraging as the South African (B.1.351) is believed to elude the current vaccines.

Federal Reserve Tapering (or rising rates)

The biggest threat continues to be inflation and interest rates. Paradoxically, the biggest risk to this market is the economy heating up too much too fast which would force the Federal Reserve to lift interest rates.

While the Federal Reserve is likely to keep rates at 0% through 2021, they may slow (taper) their purchase of assets (U.S. Treasury, Mortgage, and Corporate Bonds). The last time the Federal Reserve announced a tapering was 2013, and the market quickly sold off close to 10% in the span of three weeks. We could easily see a “taper tantrum 2.0” in 2021 as the economy opens back up. Also, Treasury yields have been increasing over the last couple of weeks and if they continue along this trajectory, higher yield could compress stock market valuations.

What Are We Doing?

Like last month, we are positioning portfolios and investment implementations in the following way:

- For clients who are funding portfolios with cash, we are being cautious with the implementation and staging in over a period of 4-6 months.

- For clients who are fully invested, we are fully diversified across our equity portfolios with a bias towards quality, growth, and companies poised to benefit from the economy reopening.

- We are diversified across U.S. stocks, Non-U.S. Developed stocks, and Emerging Market stocks.

- We are underweight fixed income.

- We are biased towards high-quality fixed income. In other words, we are not getting compensated to take risks in fixed income and we are willing to accept lower rates in exchange for preservation of capital.

Finally, I’ll leave you with this poem about the stock market from 1688. Yes, from 1688!

“I really must say that you are an ignorant person, friend Greybeard, if you know nothing of this enigmatic business [stocks] which is at once the fairest and most deceitful in Europe, the noblest and most infamous in the world, the finest and the most vulgar on earth. It is the quintessence of academic learning and a paragon of fraudulence; it is a touchstone for the intelligent and a tombstone for the audacious, a treasury of usefulness and a source of disaster, and finally a counterpart of Sisyphus who never rests as also of Ixion who is chained to a wheel that turns perpetually.”

Confusion of Confusions, Joseph de le Vega, 1688

If you would like to speak about your portfolio in greater detail, please feel free to reach out to schedule a meeting.