As we enter Q1 earnings season with the S&P 500 making new all-time highs, investor concerns are starting to pile up, especially in the wake of the April stock market rally.

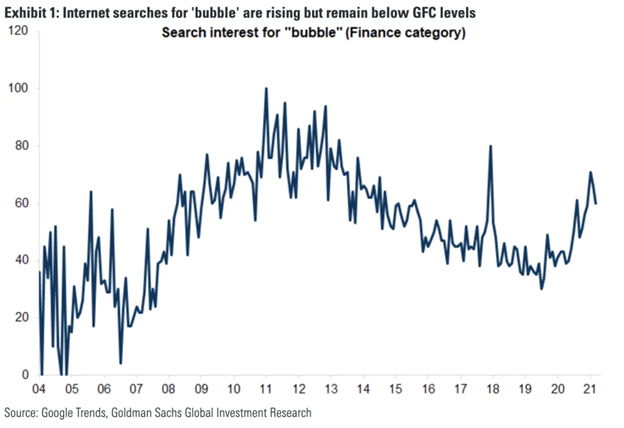

Internet searches for “bubble” have spiked in 2021, comparisons to the technology bubble of the late 1990s are mentioned with more frequency, and stock market valuations are elevated compared to history.

So, with all these concerns why are stocks up? It's simple. Earnings are up.

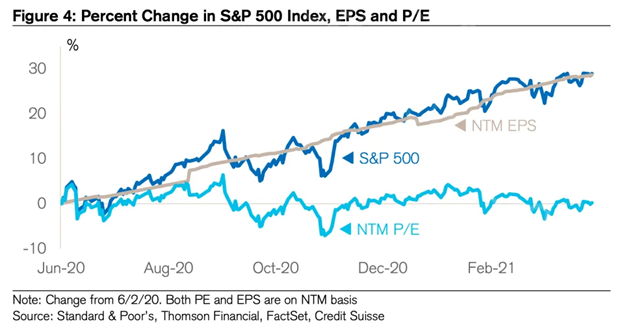

Yes, valuations are elevated, but recent fluctuations in Price/Earnings (P/E) multiples are nothing compared to the magnitude of the rebound in earnings.

The current consensus expectation for earnings growth is 22%, and the best results are forecasted to come from more cyclical sectors such as consumer discretionary, financials, and materials. While there will be a handful of high-profile misses, the results are likely to be quite good, providing more fuel for equity markets.

Over time the stock market follows the path of expected corporate earnings and the last 12 months have been no exception. Looking at the chart below, stocks have moved in lockstep with expected corporate earnings growth and as a result, valuations have remained consistent.

Today, the stock market’s forward P/E ratio is just above 20 as the S&P 500 crosses 4,000. So, what was the forward P/E ratio when the S&P 500 crossed 3,000? Just above 20. If elevated valuations kept you out of the market when the S&P 500 was 3,000 with a P/E ratio above 20, you would have missed out on strong market returns.

The low interest rate environment of the last decade has made stocks more attractive relative to bonds, and the largest companies in the market (Microsoft, Amazon, Apple, Google) can support their valuations as they produce strong cash flows, have dominant market positions, and their growth prospects remain attractive.

While elevated valuations should not be ignored, rising stock prices can be accompanied with falling valuations if earnings grow at a faster rate.

In other words, if the denominator (earnings) grows at a faster rate than the numerator (price), you have a dynamic where stocks can go up while valuations go down.

But when should we expect a “correction”?

The stock market typically experiences a “correction” (a peak-to-trough decline of -10% or more) at least once every calendar year. So, when should we expect the 2021 correction?

It may have already happened.

Several areas of the market have declined 10% or more at some point in 2021. In February and March, big technology and growth stocks sold off more than 15%. Then energy stocks declined 13% followed by small-cap stocks declining 10% in a matter of two weeks.

In other words, most of the market has experienced a “correction” in 2021, but at different times. According to research firm, Fundstrat, these “rolling corrections” have diminished the odds of a full-scale market correction.

While there are pockets of excessive valuations in stocks and euphoric investor behavior in SPACs, NFTs, Dogecoin, the broader market appears to be functioning in a healthy and rational manner. Also, the country's largest banks have strong balance sheets which was not the case in prior market bubbles. The absence of significant leverage (outside of the government sector) and the early stage of the cycle suggest that the risk of a market bubble with systemic risks to the financial system and economy is relatively low.

Make no mistake about it, risk is always present (inflation, higher interest rates, new COVID variants, higher taxes, etc.), but the presence of risk and uncertainty is precisely the reason stock investors get rewarded over time. In other words, uncertainty and volatility are the price of admission to own an asset class that historically compounds at a rate of 8%-10% annually over time.

As a result, our convictions remain consistent, and we are positioning portfolios and investment implementations in the following way:

- For clients who are funding portfolios with cash, we are staging in over a period of 3-4 months.

- For clients who are fully invested, we have a bias towards quality, growth, and sectors poised to benefit from the economy reopening.

- We are diversified across U.S. stocks, Non-U.S. Developed stocks, and Emerging Market stocks, with an overweight to U.S. stocks.

- For clients with long-term time horizons and an increased capacity for volatility, we are adding a 1-3% exposure to Crypto currencies (Bitcoin and Ethereum).

- We are underweight Fixed Income.

- We are biased towards high-quality Fixed Income. In other words, we are not getting compensated to take risks in Fixed Income and we are willing to accept lower rates in exchange for preservation of capital.

If you would like to speak about your portfolio in greater detail, please feel free to reach out to schedule a meeting.